refund for unemployment taxes 2021

1222 PM on Nov 12 2021 CST. The federal tax code counts jobless benefits as.

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

In order to have qualified for the.

. To check the status of an amended return call us at 518-457-5149. An estimated 13 million taxpayers are due unemployment compensation tax refunds. Households whove filed a tax return and are due a refund get an average of 2900 back - we explain how to track down the cash.

The irs is recalculating refunds for people whose agi is 150k or below and who filed before the tax law that changed the amount of unemployment that. With The Latest Batch Uncle Sam Has Now Sent Tax Refunds To Over 11 Million Americans For The 10200 Unemployment Compensation Tax Exemption TAX HELP 2021. Call the IRS at -- toll-free and either use the automated system or speak with an agent.

Download and complete the Form 3911 Taxpayer Statement Regarding Refund PDF. QUICKLY FIND NEW REFUND AMOUNT WITH 10200 UNEMPLOYMENT DEDUCTION USING. The IRS efforts to correct unemployment compensation overpayments will help most of the affected.

Get your tax refund up to 5 days early. Taxpayers should not have been taxed on up to 10200 of the unemployment compensation. During the month November the IRS might surprise you with a deposit or an extra refund check for your 2020 taxes.

WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust unemployment compensation from previously filed income tax returns. Irs unemployment tax refund august update. WASHINGTON The Internal Revenue Service recently sent approximately 430000 refunds totaling more than 510 million to taxpayers who paid taxes on unemployment compensation excluded from income for tax year 2020.

The American Rescue Plan Act of 2021 which became law in March excluded up to 10200 in. If your tax refund was lost or misplaced you should initiate a refund trace. My transcript says it is pending additional information and was last updated in June of 2021.

Ad Learn About the Common Reasons for a Tax Refund Delay and What To Do Next. As of Nov. Check For the Latest Updates and Resources Throughout The Tax Season.

Congress passed the American Rescue Plan Act on Mar 11 2021 which President Joe Biden signed. I have not heard anything since June when I got a letter stating that I do not need to. The average pay for an unemployment claim is 4200 but it can cost up to 12000 or more.

Of course that is just an estimate. This summer frustrated taxpayers spoke out over tax refund delays after the IRS announced the cash for unemployed Americans. Unemployment Income Rules for Tax Year 2021.

The IRS plans to issue another tranche of refunds before the end of the year. However if you filed a married filing jointly return you cant initiate a trace using the automated systems. 22 2022 Published 742 am.

You had to qualify for the exclusion with a modified adjusted gross income MAGI of less than 150000. While taxes had been waived on up to 10200 received in unemployment for those making less than. July 30 2021 837 AM flamingo1953 The IRS is sending out the refunds for the unemployment exclusion over the course of the summer.

The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. And this tax season you wont be able to rely on a tax break for unemployment insurance either. IR-2021-159 July 28 2021.

The 150000 limit included benefits plus any other sources of income. The American Rescue Plan Act of 2021 excluded up to 10200 in unemployment compensation per taxpayer from taxable income paid in 2020. It could end up taking longer than they expected.

When it went into effect on March 11 2021 the American Rescue Plan Act ARPA gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020. As of March 11 2021 under the American Rescue Plan the first 10200 in unemployment benefits collected in the tax year 2020 were not subject to federal tax. This is not the amount of the refund taxpayers will receive.

Unemployment benefits generally count as taxable income. The agency sent about 430000 refunds totaling more than 510 million in the last batch issued around. There could be some good news for those who already paid taxes on unemployment benefits that they collected in 2020 and 2021.

See How Long It Could Take Your 2021 State Tax Refund. Just as the title says I have not received my 2020 refund. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year.

The IRS has announced that it will continue to process refunds for. The unemployment tax refunds are determined by the employees earnings the length of time on unemployment and the states maximum benefit amount. The American Rescue Plan Act a relief law Democrats passed in March last year authorized a waiver of federal tax on up to 10200 of.

Summer ends September 22. ET The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer had collected in. There is no way to tell when you will get your refund for the unemployment exclusion.

Taxpayers who filed an original return resulting in tax due but scheduled a. The most recent batch of unemployment refunds went out in late july 2021. IR-2021-111 May 14 2021 WASHINGTON The Internal Revenue Service will begin issuing refunds this week to eligible taxpayers who paid taxes on 2020 unemployment compensation that the recently-enacted American Rescue Plan.

Ad Learn How Long It Could Take Your 2021 State Tax Refund. IR-2021-212 November 1 2021.

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Irs Starts Sending Tax Refunds To Those Who Overpaid On Unemployment Benefits Cbs News

Unemployment Tax Updates To Turbotax And H R Block

Tax Tip More Unemployment Compensation Exclusion Adjustments And Refunds Tas

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Interesting Update On The Unemployment Refund R Irs

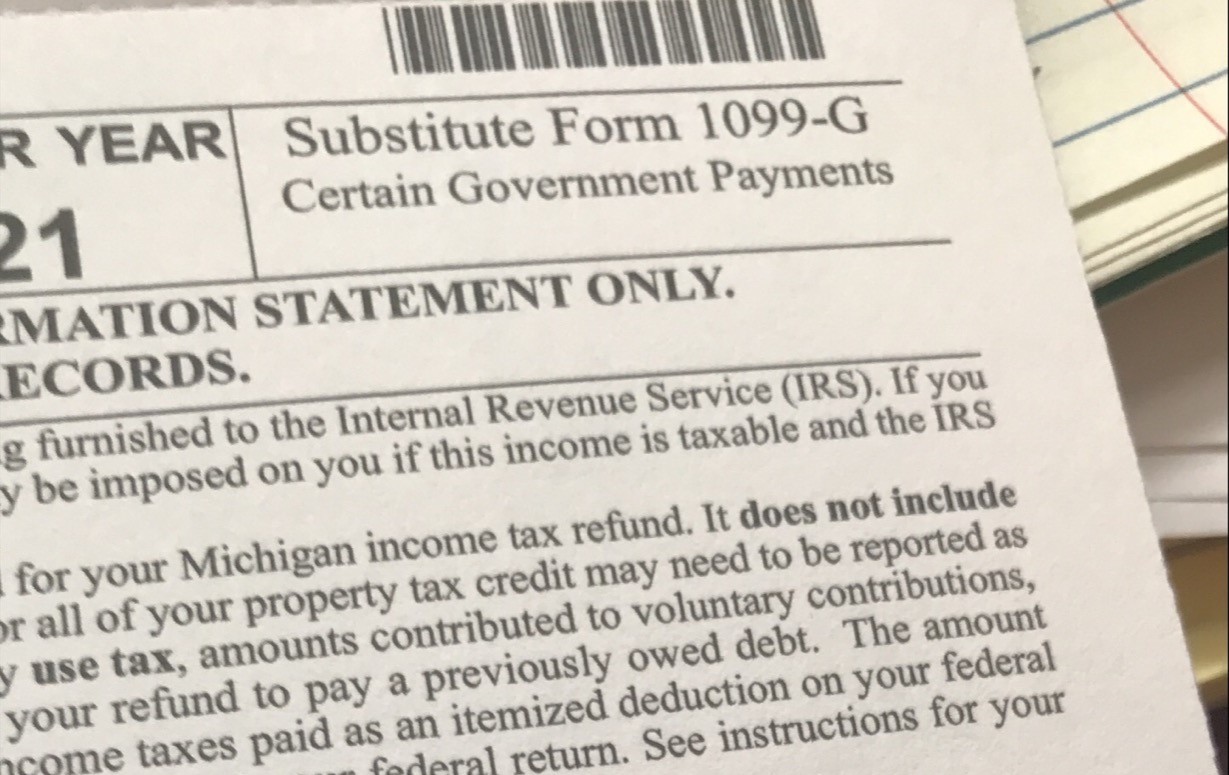

1099 G Unemployment Compensation 1099g

When To Expect Unemployment Tax Break Refund Who Will Get It First As Usa

Michigan S Delayed 1099 G Unemployment Tax Forms Now Available Online Mlive Com

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Irsnews On Twitter Irs Is Issuing Refunds For Taxes On 2020 Unemployment Compensation That Were Paid Before They Were Excluded From Taxable Income By Recent Law Changes Details At Https T Co Hcqbfq5oze Https T Co Tt4lhu7uff

Unemployement Benefits Will I Get A Tax Refund For This Benefit Marca

Confused About Unemployment Tax Refund Question In Comments R Irs

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

Still Waiting On Your 10 200 Unemployment Tax Break Refund How To Check The Status

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time